INDONESIAN CONCRETE PILE INDUSTRY: ITS CONDITION AND PROSPECTS.

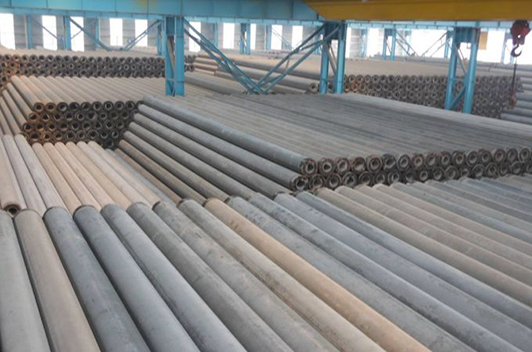

The rapid growth of the construction sector in Indonesia has enabled the industry of concrete piles to continue developing. This can be seen from the fact that them are a lot of construction projects such as office buildings, apartment buildings, real estates, shopping centres, and overpasses currently underway. Such projects require concrete piles in large quantities. Meanwhile, the domestic industry of concrete piles has shown rapid output growth and is now operating nearly at its capacity level.

The installation of concrete piles at high-rise building projects poses a certain problem. Concrete piles are normally made and installed at the project site. This practice is time-consuming and costly, in addition to being risky, the practice of making concrete piles at the project site increases the personnel demand of the project in question because concrete piles can be made only by people with a special skill. In view of this, ready-for-use, high-quality concrete piles need to be made available.

One advantage of procuring ready-for-use concrete piles from a producer is that they are cheaper and, hence, the high-rise building project in question can save money. Another advantage is that such piles have guaranteed quality and their installation at the project site will not fail. In addition, their installation is a quick process which requires personnel in low quantities. So, a construction project which uses ready-or-use concrete piles can keep its operating expenses low.

This report discusses the population of concrete pile producers, their production capacities, and their actual production rates. In addition, it also discusses the industries which use concrete piles. This report ends with estimates of domestic concrete pile consumption for 1996 and projections of demand for the 1997-2001.

Concrete pile producers: their population and production capacities

According to a source with the Department of Industry and Trade, there are currently 36 companies dealing in the production of concrete piles and concrete electricity poles in Indonesia with a combined production capacity of 1,280,000 units per annum. However, only 20 of these companies are still in operations.

Generally, a concrete pile producer also turns out other concrete products. In terms of production capacities, the largest concrete pile producer in Indonesia is PT Wijaya Karya (WIKA) (316,000 units/annum). Operating under the supervision of the Department of Public Works, WIKA originated from a Dutch construction company called "Naamloze Vennootschaap Technische Handel Maattschappij en Bouwbedrif Vie en Co" (N.V. Vis en Co). In March 1960, N.V. Vis en Co was taken over by the Indonesian Government. In 1972, it changed its status into a limited-liability company and its name into PT Wijaya Karya (WIKA).

WIKA, which started off as a producer of concrete electricity poles, has managed to become the leading producer of precast concrete piles in Indonesia. Currently, WIKA operates 8 plants and they are located in West Java (Bogor and Cirebon), Central Java (Solo), East Java (Pasuruan), Lampung, North Sumatra (Medan), and South Sulawesi (Ujungpandang).

Besides concrete piles and concrete electricity poles, WIKA--a state enterprise based in Jakarta--also produces conncetors, railway concrete sleepers, railway concrete crossings, steel constructions, prestressed concrete pipe, mould & dies, hot dip galvanizing, and solar water heaters.

One of WIKA's leading products which has recently been introduced to the market is core type prestressed concrete pipe, which is produced in Ujungpandang, South Sulawesi. This high-technology concrete pipe is a new product in Indonesia. WIKA's performance is internationally recognized by the London-based Lloyd's Register Quality Assurance (LRQA). This state enterprise has obtained eight ISO 9000 certificates of series 9001 and 9002.

Another outstanding concrete pile producer in Indonesia is PT Jaya Beton Indonesia (JBI) of the Jaya Group. This company produces concrete piles and concrete electricity poles at two plants, one in Medan (North Sumatra), and the other in Surabaya (Fast Java). Jointly owned by PT Pembangunan Jaya, Ir. Soekrisman, Ir. Ciputra, Ir, Hiskak Secakusuma, and a number of other individuals, this company also produces ready mixed concrete and centrifugal reinforced concrete pipes (hume pipes). In 1995, PT JBI--whose head office is located at Wisma Bisnis in Jakarta--turned out 66,987 units of concrete piles and 14,120 units of concrete electricity poles and booked Rp 27.5 billion in total sales.

Another concrete pile producer is PT Tonggak Ampuh, which produces conventional reinforced concrete piles and prestressed concrete piles and has an annual production capacity of 183,000 units. With its plant located in Bogor (West Java), PT Tonggak Ampuh also produces other concrete products such as conventional reinforced concrete beams for bridges, prestressed concrete beams for bridges, prestressed concrete sleepers for railways, reinforced concrete sleepers for railways, prefabricated concrete panels for houses, concrete pipes, concrete stakes, and concrete fences. TO facilitate deliveries of orders, PT Tonggak Ampuh also operates its own fleet of transportation vehicles.

PT Beton Megah Perkasa is another important concrete pile producer in Indonesia. With its plant located in Gowa (Ujungpandang, South Sulawesi), this company has the capacity to produce 32,000 units of concrete piles and 8,000 units of concrete electricity poles per annum.

PT Kalimantan Agung, which was established under the domestic investment (PMDN) scheme in Banjarmasin (South Kalimantan) in 1987, has the capacity to produce 24,000 units of concrete piles per annum. Meanwhile, PT Paramategak Beton Indonesia--whose plant is located in Jakarta--specializes in producing concrete piles for building construction purposes. This company commenced its operations in 1987.

Table - 1

Concrete pile producers and their production capacities, 1997

(Units/year)

Production

Producers Location of plant capacity

PT Wijaya Karya Boyolali, Medan, Lampung 316,000

Pasuruan, Ujung Pandang,

Bogor, West Java

PT Tonggak Ampuh Bogor, West Java 183,000

PT Jaya Beton Indonesia Medan, North Sumatera 126,600

Surabaya, East Java

PT Megaguna Concrete Kendal, Central Java 61,000

Pontianak, West Kalimantan

PT Bima Putra Nusantara South Lampung, Lampung 60,000

PT Beton Megah Perkasa Gowa, South Sulawesi 40,000

Medan, North Sumatera

PT Jaya Daido Concrete Tangerang, West Java -

PT Hume Sakti Ind. Jakarta 36,000

PT Betontama Pratekan Bekasi, West Java 30,000

Nusantara

PT Ratu Pola Bumi Panjang, Bandar Lampung 25,000

PT Kalimantan Agung Tanah Laut, Kalimantan 24,000

PT Kala Goaka Industri Samarinda, Kalimantan 17,500

PT Sumatera Beton Medan, North Sumatera 12,000

PT Paramategak Beton Jakarta -

Indonesia

PT Concindo Arya Raya Kutai, East Kalimantan -

Others 348,900

Total 1,280,000

Source: Department of Industry and Trade/Data Consult

Production up 3.7% annually

With the rapid growth of construction sector, Indonesia's concrete pile Production has continued to increase. In 1992, it reached 754,000 units, which rose to 1,000,000 units in 1996. Thus, for the period of 1992-1996, It grew at an average annual rate of 3.7%. Over the same period, the concrete pile industry operated at 70.3% of its capacity level.

Of the different types of concrete piles, the most produced are concrete poles for the distribution of low- and medium-voltage electricity. Concrete electricity poles account for around 60% of Indonesia's total annual concrete pile production. Concrete electricity poles are almost exclusively consumed by PLN.

Table - 2

Indonesia's concrete pile production, 1992 - 1996

Production Growth

Year (000 units) (%)

1992 754 -

1993 800 1.6

1994 950 3.9

1995 960 5.0

1996 1,000 4.2

Average growth 3.7

Source: Department of Industry and trade/Data Consult

WIKA as the most important pioneer

PT Wijaya Karya (WIKA) is the most important pioneer of Indonesia's concrete industry. Its concrete product range is quite popular. Early in 1980, WIKA --a state enterprise under the supervision of the Department of Public Works-- became the first company to produce concrete electricity poles in Indonesia. According to some information, over two million units Of WIKA's concrete electricity poles have been installed along 100,000 kilometers of streets/roads throughout Indonesia. In addition, over one million of its railway sleepers have been installed at railways, and over 4.5 million meters of its concrete piles have been installed at various large and monumental buildings. Its other concrete products such as telephone poles and bridge beams have strengthened WIKA's position as the most important pioneer of the prestressed concrete industry in the country.

In 1995, Indonesia produced a total of 960,000 units of concrete piles, which accounted for 73.8% of its concrete pile production capacity. Of the different concrete pile companies, WIKA produced the most, namely 319,228 units or 34.7% of the total, followed by PT Tonggak Ampuh with 100,183 units, PT Jaya Beton Indonesia with 81,107 units, and PT Jaya Daido Concrete with 79,092 units. The other companies produced less than 50,000 units each.

Table - 3

Indonesia's 1995 concrete pile production, by producers

Production Share in

Producers (units) total (%)

PT Wijaya Karya 319,228 34.7

PT Tonggak Ampuh 100,183 10.9

PT Jaya Beton Indonesia 81,107 8.8

PT Jaya Daido Concrete 79,092 8.6

PT Paramategak Beton 37,500 4.1

PT Beton Megah Perkasa 33,000 3.6

PT Hume Sakti Ind. 31,053 3.4

PT Megaguna Concrete 26,439 2.8

PT Kalimantan Agung 7,965 0.8

PT Concindo Arya Raya 7,000 0.7

Others 196,433 21.6

Total 960,000 100.0

Source: Department of Industry and Trade/Data Consult

Marketing system

In Indonesia, concrete piles are distributed to users upon orders and to the free market. Apart from this, a number of companies produces concrete piles specially for distribution to their own affiliates which deal in the construction sector. As for concrete pile producers which do not have affiliates that deal in the construction sector, they offer their products to construction projects. The procurement of concrete piles is usually handled by the contractor which implements the construction project in question. Generally, the foundation construction work is separated from the high-rise building construction work, and the former is handled by a contractor which specializes in the installation of piles. In marketing its products, a supplier of concrete piles usually contacts such a contractor.

As for concrete electricity poles, they are marketed either to the contractors of the state-owned power supply company PLN or directly to PLN. A supplier of concrete electricity poles to PLN usually also handles the installation of the poles.

In most cases, concrete electricity poles are required for the development of new distribution networks. In this regard, PLN tenders the purchasing and installation of the poles to contractors. However, for purposes related to the replacement of old poles, PLN usually handles the purchasing of concrete electricity poles itself.

Basic materials

The main basic materials for the production of concrete piles are cement, sand, concrete, split, steel, and gravels. However, the composition of basic materials for the production of concrete piles varies from one producer to another. WIKA, for example, uses cement, prestressed concrete steel, sand, and gravels. These basic materials are processed through concrete mixing into concrete filling, which is subsequently filled into moulds for pressing purposes. The moulds with concrete Filling in it are rotated, washed, and cleaned. Finally, the moulds are removed by means of water.

WIKA's basic material requirements have continued to increase. Its cement demand, for example, rose from 1.1 million sacks in 1992 to 1.6 million sacks in 1995. Over the same period, its prestressed concrete steel demand grew from 5,513 tons to 8,289 tons.

PT Tonggak Ampuh uses cement, prestressed concrete steel (imported), sand, nail, wire, and stone as basic materials. Meanwhile, PT Jaya Beton Indonesia uses locally produced cement, sand, and stone and imported admixture, steel bars, iron wire, and R.C. bars.

Table - 4

PT WIKA's basic material requirements for concrete pile production, 1992 - 1995

Basic material 1992 1993

-Cement (sack) 1,059,115 1,398,775

-Prestressed concrete 5,513 6,374

steel (ton)

-Sand ([M.sup.3]) 53,797 71,923

-Gravel ([M.sup.3]) 70,972 98,510

Basic material 1994 1995

-Cement (sack) 1,357,567 1,591,875

-Prestressed concrete 7,078 8,289

steel (ton)

-Sand ([M.sup.3]) 70,868 86,463

-Gravel ([M.sup.3]) 96,136 108,733

Source: Department of Industry and Trade/Data Consult

Types of concrete piles

There are two types of concrete piles, namely prestressed concrete piles and prestressed spun concrete poles (concrete electricity poles). The concrete piles produced by PT Tonggak Ampuh are reinforced concrete piles and prestressed concrete piles. PT Tonggak Ampuh produces these types of concrete piles in line with the applicable standard requirements.

Meanwhile, PT Jaya Beton Indonesia (JBI) produces high-quality concrete piles using the JBI system in combination with pressing and heating. PT JBI's concrete products are made of high-density materials with very low absorbant power which are highly resitant to corrosion and impact, practical to use, portable, and elastic.

Concrete piles and concrete electricity poles vary in length from 6 to 14 meters. WIKA produces concrete electricity poles which vary in length from 9 to 14 meters and in weight from 525 to 1,150 kgs per unit.

Table - 5

Specifications of PT Tonggak Ampuh's concrete piles

Details

Basic material : Cement, prestressed concrete

steel, sand, nail wire,

dan stone

Quality of concrete : Normal : K. 350 K. 500

Quality of reinforcement steel : Normal : U. 32 U. 39

Quality of prestressed steel : St 145/165, for wire (ASTM

421-77) Standard JIS, ASTM/BS

diameter 7 mm up to 12, 7 mm

Length of product : Customized

Weight of product : Customized

Shape of cross section : Normal, square; or customized

Source: TA/Data Consult

User-industries

The main users of concrete piles/poles are the construction sector and PLN. Construction companies use concrete piles as stakes and foundations while PLN uses them to make electricity networks.

A construction company provides construction services, and its final products are buildings/structures which are inseparable from the land where they stand. They are, among others, office buildings, roads/streets, bridges, railways, railway bridges, tunnels, drainage systems, sanitary buildings, airport runways, berths, power plants, transmission networks, and distribution networks.

The scope of activities of a construction company comprises planning, preparations, construction work, dismantling, and repair work. Concrete piles are required by construction companies to implement their activities.

A construction company uses concrete piles to establish the foundations of buildings. Large-size concrete piles are required in the ease of high-rise/large building projects. In the construction of small buildings such as houses, shop-houses, and warehouses, small-size concrete piles are used.

In view of the current economic situation, the companies associated under GAPENSI (the Indonesian Construction Companies' Association) have decided to compromise the quality of their products in order to prevent high financial losses. The tight money policy has driven up the prices of certain building materials by around 10%, and this has caused construction companies to suffer financial losses equivalent to 2%-7% of the value of the project. Earlier, a construction company could enjoy profit equivalent to 5%-7% of the value of the project.

Table - 6

Contractors dealing in installation of concrete piles, 1997

Name of company Address Remark

PT Palu Mas Pile J1. Mangga Besar Raya, Mini pile

Jakarta 11160

PT Menara Wira Pratama J1. Siantar No. 2 Bored pile

Jakarta 10150

PT Frankipile Indonesia J1. Kemang Selayan 151 Bored pile

Jakarta

PT Bauer Pratama Cilandak Commercial Est. Bored pile

Indonesia J1. Cilandak KKO,

Jakarta

PT Pakubumi Semesta J1. Raden Saleh No. 51 Piling

Jakarta 10330

PT Berdikari Pondasi J1. P. Tubagus Angke 99 Bored pile

Perkasa Jakarta

PT Reka Gunatek Persada J1. Pegangsaan Dua KM 4,5 Foundations

Jakarta specialist

Source: Data Consult

Besides the construction sector, the other user of concrete piles/poles is PLN. During the First Phase of Long-term National Development, the generation of electricity grew twofold, and this tendency is expected to continue during the current Second Phase. In principle, electricity development is intended to achieve the Government's targets as follows: to electrify all households in Indonesia by the end of the Second Phase of Long-term National Development; to electrify all villages by the end of the 7th Pelita (Five-year National Development Plan), and to fulfill the industrial sector's electricity demand.

Electricity demand has continued to grow with Indonesia's economy and population. This condition seems to have caused the consumption of concrete electricity poles to continue increasing. According to some information, PLN requires 400,000-600,000 units of concrete electricity poles annually. Indonesia's total production of piles/poles is 1,000,000 units annually. The balance is absorbed by the construction sector and exported.

The Government's rural electrification program continues to be implemented. To save on oil fuels and to promote energy diversification, the Government is cutting down on the use of oil fuels and developing alternative sources of energy such as hydropower, wind energy, solar power, and biomass.

Exported

Besides being supplied to the domestic market, Indonesian concrete piles/poles are also exported. Although the volume of such exports continues to fluctuate, it has shown the tendency to increase. In 1991, as many as 12,452 units (worth US$ 824,000) were exported, and this figure rose to 53,246 units in 1992. In the following years, due to the rapid growth of the domestic construction sector, the volume of such exports declined. In 1996, it reached only 44,427 units (worth US$ 2.4 million), down 72.6% from the previous year.

Table - 7

Indonesia's concrete pile exports, 1991 - 1996

Volume Value

Year (units) (US$'000)

1991 12,452 824

1992 53,246 2,853

1993 669 68

1994 10,537 439

1995 162,369 9,892

1996 44,427 2,412

Source: CBS/Data Consult

Indonesia exports concrete piles to a number of countries, of which Singapore is the largest importer. In 1996, for example, Singapore imported 43,442 units of concrete piles (worth US$ 2.2 million) from Indonesia, which accounted for 97.7% of the latter's total concrete pile exports for the same year. Singapore's concrete pile demand has been high because the country has been actively building high-rise office and apartment buildings and other facilities. Another country which imports concrete piles in significant quantities from Indonesia is the Philippines. In 1996, Indonesia supplied the Philippines with 805 units worth US$ 173 thousand. The shares of the other countries in the total volume of Indonesia's concrete pile exports have been relatively small.

Table - 8

Indonesia's 1996 concrete pile exports, by country of destination

Country of Volume Value

destination (units) (US$'000)

Singapore 43,442 2,194

Philippine 805 173

Taiwan 80 4

U.S.A 57 29

Others 43 12

Total 44,427 2,412

Source: CBS/Data Consult

Attractive to new investors

The investor interest in the concrete pile industry seems to be quite high. This can be seen from the tact that for the period of 1996-August 1997, at least four new projects in this industry were approved by the Investment Coordinating Board (BKPM). These four projects belong to, respectively, PT Hume Concrete Product Indonesia (HCPI), PT Sindo Bintan Precase, PT Gemacatur Saranadharma, and PT Karsa Prima Pertama Nusa. The first two projects were approved under the foreign investment (PMA) scheme, and the other two under the domestic investment (PMDN)scheme.

PT HCPI, whose concrete pile project was approved under the PMA scheme in November 1996, is jointly owned by PT Aria Hasta Pramindo and its foreign partner HIMB Overseas Ltd. of Channel Islands. According to a source with the BKPM, this project is located in Karawang, West Java and requires an investment commitment of US$ 12.6 million. It will have the capacity to produce 950,000 tons of reinforced concrete piles and 150,000 tons of prestressed concrete piles per annum. PT HCPI is scheduled to commence its commercial production early in 2000.

PT Sindo Bintan Precast's concrete pile project was also approved under the PMA scheme by the BKPM. This project --which is jointly owned by Bintan Nusamulti International Pte. Ltd. of Singapore and Singaporean businessman Tan Siew Lok-- requires an investment commitment of US$ 3.1 million. It will be located on the Bintan Island in Riau and will have the capacity to produce 12 million units of conblocs and 873,000 cubic meters of prestressed concrete piles per annum. If this project is implemented as scheduled, PT Sindo Bintan Precast will commence its commercial production early in 2000.

PT Gemacatur Saranadharma's concrete pile project was approved under the PMDN scheme by the BKPM in June 1997. This Rp 14.3 billion project will be located in Bogor, West Java, and will have the capacity to produce 220,000 cubic meters of concrete piles per annum.

PT Karsa Prima Pertama Nusa's concrete pile project was also approved under the domestic investment scheme. This Rp 22.4 billion project will be located in Langkat (North Sumatra), and it will have the capacity to produce 300,000 tons of paving block, 350,000 tons of concrete piles, and 350,000 tons of concrete ready mixed piles per annum. The company is scheduled to commence its commercial production in April 2000.

Table - 9

New project in concrete pile industry, 1996 - August 1997

Production

Location of capacity

Name of company project (per year)

PT Hume Concrete Karawang, -Reinfoced

Product Indonesia West Java concrete

950,000 tons

-Prestressed

concrete

150,000 tons

PT Sindo Bintan Bintan Island, -Conbloc

Precast Riau 12,000,000 pcs

-Prestressed

concrete

873,000 [m.sup.3]

-Reinforced

concrete

80,000 tons

PT Gemacatur Sarana- Bogor -Prestressed

dharna West Java concrete pile

220,000 tons [m.sup.3]

PT Karsa Prima Langkat, -Concrete pile

Pertama Nusa North Sumatera 350,000 tons

Investment

commitment

Name of company (million)

PT Hume Concrete US$ 12.6

Product Indonesia

PT Sindo Bintan US$ 3.1

Precast

PT Gemacatur Sarana- Rp 14,300

dharna

PT Karsa Prima Rp 22,240

Pertama Nusa

High-rise buildings the largest consumer of concrete piles

Overall, the largest consumer of concrete piles/poles in Indonesia is PLN, which uses them to establish power distribution networks. PLN accounts for an estimated 60% of the total domestic consumption of concrete piles/poles.

As for concrete piles, demand varies highly from one project to another, depending on the soil density, the dimensions of the ground floor, the construction scale, and the height of the whole structures. In Data Consult's calculations, the construction sector's 1996 total demand for concrete piles was 400,000 units. In the construction sector, the largest consumer of concrete piles is high-rise buildings such as hotels, apartment buildings, office buildings, and shopping centers. They account for 40.5% of the construction sector's total concrete pile consumption. The other 59.5% is absorbed by infractructure, factory buildings, and other structures.

Table - 10

Estimates of concrete pile consumption for 1996, by user

User Volume Share in

(000'units) total (%)

High-rise buildings 162 40.5

Infrastructure 100 25.0

Factory buildings 82 20.5

Others 56 14.0

Total 400 100.0

Source: Data Consult

Prospects and conclusions

For 1997, the growth of the construction sector is expected to slow down a bit due to the recent monetary turbulence and to the resulting issurance of the tight money policy, which has driven up bank interest rates. This condition has caused a number of non-infrastructure projects to be rescheduled. As a result, the growth in the demand for concrete piles will slow down slightly. However, this crisis is not expected to go on for an extended period of time. Next year, things are expected to go back to normal.

Up to now, construction project implementors at regional levels have been making their own concrete piles at project sites. This practice poses problems in terms of time- and cost-efficiency and quality. In the years to come, ready-for-use concrete piles are expected to gain more and more popularity because they are practical.

In 1996 alone, according to data from the BKPM, as many as 82 new construction projects were approved, and they will require concrete piles. These 82 projects comprise hotels, apartment buildings, office buildings, and shopping centers. In addition, a number of projects on the construction of factory buildings were also approved in the same year. All these projects are expected to enter the construction stage next year. The potential demand for concrete piles for 1998 and the years to come will increase further from a number of infrastructure construction projects such as roads/streets, toll roads, and bridges. In Data Consult's calculations, the domestic demand for concrete piles will reach 490,300 units in 1998, and this figure will increase to 666,400 units in 2001.

The annual demand for concrete electricity poles is not expected to change much; it is usually the same as PLN's medium -and low voltage network development target. In view of this, Data Consult projects. The average annual growth in the domestic demand for concrete electricity poles for the period of 1997 - 2001 at 5%.

Table - 11

Projections of concrete pile demand for, 1997 - 2001

(000 units)

Year Concrete Concrete Total

electricity pile

poles

1997 630 438 1,068

1998 662 490 1,152

1999 695 543 1,238

2000 729 601 1,330

2001 766 666 1,432